Fiscal advantages

The Allard Pierson is a so-called ‘Algemeen nut beoogende instelling’ (referred to by the Dutch acronym ANBI), which means it is designated as a cultural public benefit organisation by the Dutch tax authorities.

Both a financial donation and a donation in kind can have fiscal advantages. The financial value of a donation in kind is determined by an official taxation. The Allard Pierson is exempt from tax on all acquisitions made through donations and testamentary dispositions. That means that the Allard Pierson does not pay Dutch inheritance or gift tax on them.

Donations to the Allard Pierson can take various forms. Because the Allard Pierson is recognised as an ANBI, your donation is fully deductible from your income or corporate tax. In addition, a multiplier means that 125% of the first € 5,000 of donations to a cultural institution, such as the Allard Pierson, is tax deductible. In other words, you can deduct a quarter more than you actually donated from your tax return.

The Dutch tax authorities add up multiple gifts to different ANBIs made in one year. If you donate more than € 5,000 a year to cultural institutions, then the amount above € 5,000 is still tax deductible at 100%, so without the percentage multiplier increase. You can use the ANBI calculator to get an indication of your fiscal advantage.

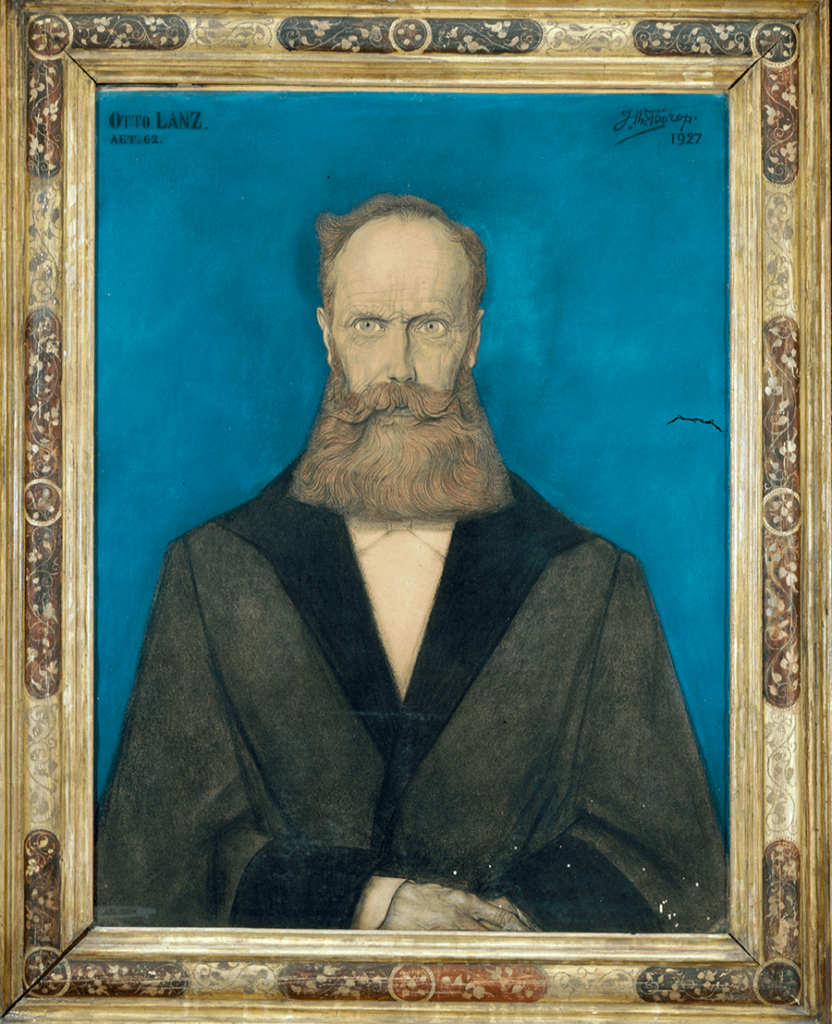

Portrait of Otto Lanz, Jan Toorop, 1927